Annual Dues Renewal

When Are Payments

Due?

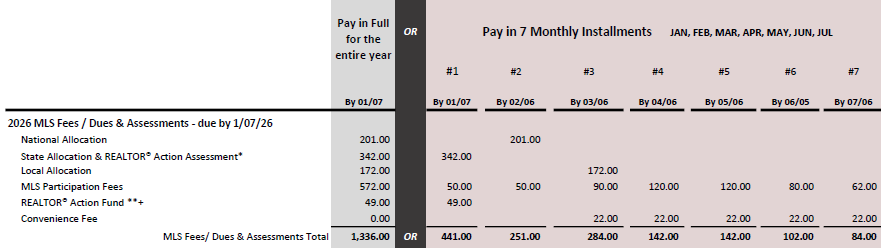

2026 Dues and/or MLS Fees renewal payments are due Wednesday, January 7, 2026. Please pay on time to avoid a $30 late fee and possible interruption in services.

“MONTHLY from January to July” Option:

• New Extended dues dates: Remaining monthly payments are due by February 6, March 6, April 6, May 6,June 5 and July 6.

• Each installment has its own due date; installments are not interchangeable.

• Please don’t pay installment in the wrong order to

attempt to pay less. Your account will be penalized in January if the first

installment is still showing unpaid--regardless of other installments you

may have paid.

• We will send email reminders for each installment. We suggest

that you set reminders on your calendar or sign up for automatic payments

(details below).

Payment Options

Your entire annual statement is divided into seven installments.

You have two payment options:

1. Pay in full. Pay it all

at once, at the beginning of the year or earlier.

2. Pay monthly. Pay every month for the first 7 months between January and July.

*REALTOR® ACTION ASSESSMENT & FUND: Explanation and Legal Notice

California Association of REALTORS® (C.A.R.)Political Action Committees: C.A.R. sponsors four Political Action Committees (PACs). CREPAC is used to support state and local candidates to further the goals of the real estate industry. CREIEC is an independent expenditure committee that independently advocates for or against candidates in accordance with the interests of the real estate industry. CREPAC/Federal supports candidates for the U.S. Senate and House of Representatives. IMPAC supports local and state ballot measures and other advocacy-oriented issues that impact real property in California. IMPAC is funded by your due’s dollars. C.A.R. also supports the Advocacy Local Fund (ALF), anon-PAC fund for expenditures on general advocacy activities.

*REALTOR® Action Assessment (RAA): This mandatory $168 state political assessment may be satisfied in one of two ways: either (1) a voluntary contribution to CREPAC, CREIEC, and/or IMPAC and/or other related political purposes or(2) a designation of the funds for political purposes in the C.A.R. general fund. You may include the entire amount on one check and if you do so,$168 will go into CREPAC, CREIEC and/or IMPAC, or other related political purposes. If you have an assessment that would result in a contribution of over $200 to CREPAC due to your DR and nonmember count, then any such amount that exceeds the $200 CREPAC limit will go into CREIEC. If you choose not to contribute to a PAC, you must do so in writing and the entire assessment of $168 will be placed in the C.A.R. general fund and used for other political purposes. PAC contributions from the REALTOR® Action Assessment will be allocated among CREPAC, CREIEC, IMPAC and possibly ALF. The allocation formula is subject to change. Payment of the assessment is a requirement of maintaining membership.

**+REALTOR® Action Fund (RAF): REALTORS®, and REALTOR-ASSOCIATES® may also participate in RAF by including an additional voluntary contribution on the same check as your dues and assessment payment. Forty-nine dollars ($49) is the suggested additional voluntary contribution but you may give more, or less, or nothing at all. No member will be favored or disfavored by reason of the amount of his/her contribution or his/her decision not to contribute. Contributions to the REALTOR® Action Fund will be allocated among C.A.R.’s political action committees (CREPAC, CREIEC, and CREPAC/Federal) according to a formula approved by C.A.R. depending on whether it is a personal or corporate contribution. The allocation formula is subject to change including re-designating a portion to IMPAC and ALF. Failure to contribute to RAF will not affect an individual’s membership status in C.A.R. +Optional

Political contributions are not deductible as charitable contributions for federal and state income tax purposes. Federal and State law prohibit any individual from making political contributions (either RAA or RAF)in the name of on behalf of any other person or entity.

NOTICE REGARDING DEDUCTIBILITY OF DUES, ASSESSMENTS AND CONTRIBUTIONS

2026 ESTIMATED PORTION OF YOUR DUES USED FOR LOBBYING THAT ARE NON-DEDUCTIBLE:

NAR 27.36% $55.00

C.A.R. 52.89% $180.89

Local 0.00% $0.00

Total Non-Deductible (Lobbying) Dues Portion: $ 235.89

Dues payments and assessments for your local association, C.A.R. and NAR, and contributions to RAF are not tax deductible as charitable contributions. However, the dues portion of your bill, excluding the portion of dues used for lobbying activities, REALTOR® Action Assessment and REALTOR® Action Fund may be deductible as ordinary and necessary business expenses. Contributions to C.A.R. Housing Affordability Fund are charitable and tax-deductible to the extent allowed under both federal and state law. Please consult your tax professional.

View the full disclosure at: https://drive.google.com/file/d/13p0mJCF36du4h3KG5onPO48K5Pnz3uvy/view?usp=sharing

How Do I Pay?

We accept AMEX, Visa,

MasterCard, Discover, Check, Telecheck (online only),

and cash. You can pay:

1. Online

3. Mail Your Payment

4. Fax Your Payment

5. In Person

6. Over the phone

2026 Membership Renewal FAQ’s

Q1: What can I expect for 2026?

A: 1) A 7 MONTH Payment Plan for REALTORS® and MLS users. Making your renewal affordable! During times of increased costs, we understand the need for an affordable Payment Plan.

2) Extended due dates and low payment plan fees: Due dates are Jan 7, Feb 6, Mar 6, Apr 6, May 6, Jun 5 and Jul 6 with a $22 convenience fee added in March, April, May, June and No fees for the first two installments.

3) Pay in full anytime in December 2025 for a chance to win a refund of your local dues and MLS fees. Refunds will be awarded to Three REALTORS® and One If you win, we'll call you in January 2026!

Q2: What are my payment options?

A: 1) Pay in full-We recommend this option.

2) Pay Monthly for each installment-Pay one invoice every month, between January and July. (Most affordable option!) We highly recommend setting up autopayments.

Q3: What payment methods do you accept?

A: All credit cards, checks, and cash are accepted. You may pay in person, by mail, or online. Simply go to www.ranchosoutheast.com log into My Account. You may also take

advantage of our automatic payment option using a valid credit card by enrolling online. Make sure to add a credit card in your "Payment Information" section and select the

appropriate auto-pay option in "Your Preferences" section (In Full or Payment Plan). If you mail a check, please mail to our Rancho Southeast REALTORS® office. If you need

your payment posted in 2025 for tax purposes, we must receive the check no later than 5pm on Thursday, December 26th, 2025, to guarantee a receipt dated 2025.

B: NOTE: If paying by check, the office can no longer issue a single check covering multiple agents. If the office wishes to pay on behalf of the agents, it must provide an

individual check for each agent.

C: NO GIFT CARDS ACCEPTED

Q4: When are payments due?

A: Whether you pay in full or in installments, we must receive your January payment no later than Monday, January 7, 2026. Postmarks do not count. Please pay on time to avoid a $30 late fee and suspension of REALTOR® and MLS services. Remaining payments are due from February 6, March 6, April 6, May 6, June 5 and Jul 6. We will send reminders for each installment while you are active and current on the payment plan. Paying the subsequent installments on time will avoid suspension of services and a $20 reconnect fee. Renew before February 28, 2026, to avoid a $50 C.A.R. Late Fee.

Q5: What are convenience fees?

A: A convenience fee applies when membership dues remain unpaid beyond March 16, 2026.

If there is a remaining balance on your account, the following fees will be applied:

$22 on March 1, 2026

$22 on April 1, 2026

$22 on May 1, 2026

$22 on June 1, 2026

$22 on July 1, 2026 (final fee)

This results in a maximum total of $110 in convenience fees.

Q6: What if I temporarily cancel my RSR® membership or choose to renew later in the year?

A: Even if you cancel your RSR® membership or do not renew on time, your local, state, and national REALTOR® dues allocations are still due in full for the entire calendar year. The payment plan also may not be available at the time you return or will become less affordable from missed installments. Late fees may still apply.

Q7: What happens if my license status changes after renewing my membership?

A: To maintain continuous access to tools such as zipForm®, MLS, and Supra, brokers and salespersons shall maintain a current, valid California real estate license. For example, the license cannot be in non-working status such as "Licensed NBA" and/or a status for which the applicant cannot perform acts for which a real estate license is required in California. Failure to stay in an active valid license status will result in suspension of services until eligible for reinstatement. For questions regarding CA DRE licensing or licensing renewal help, please view our free RSR® License Renewal Support https://ranchosoutheast.com/services/Licensing/

Q8: As a Broker, what do I need to know?

A: Your MLS participation fees must be paid on time for your agents to have access to the MLS (MLS Rule 4.2.1). Even if your agents have paid their 2025 MLS fees on time, your failure to pay on time will affect their access. Your entire office will show as inactive in the MLS until your fees are paid. MLS access fees will still be due in their entirety and not eligible for proration.

Q9: As a Designated REALTOR® (usually Broker), what do I need to know?

A: Annual dues will include a separate non-member assessment bill when applicable. Full payment of the assessment is required to maintain your REALTOR® membership and the REALTOR® status of all agents in your office. Agents who do not renew timely will each trigger the creation of a $549 non-member assessment fee. Our broker compliance team will work with you in managing compliance.

Q10: What if I want to request a refund?

A: Please note that all NAR, C.A.R., MLS, and RSR® dues, assessments, and late fees are strictly non-refundable.

As a Designated REALTOR®

(usually the Broker), What Do I Need to Know?

What is the Non-Member Assessment?

The Non-Member Assessment applies to agents affiliated with your office who have not paid their REALTOR® dues.

Who is responsible for this assessment?

As the Designated REALTOR® (DR), you are responsible for ensuring the assessment is paid in order to maintain your REALTOR® membership and the REALTOR® status of all agents in your office.

What happens if an agent does not pay?

Each unpaid agent will result in an additional 2026 Non-Member Assessment of $549.00 being applied to your account.

How can I avoid additional charges?

You may:

• Require the agent to pay their renewal invoice

• Remove the agent from your license

• Pay the assessment fee on the agent’s behalf

What

Portion of My Dues Are Not Deductible?

Primary REALTORS®, please refer to the reverse of your invoice for the full details:

2026 Estimated Portion of

Your Dues that are Non-Deductible

1. NAR - $55.00 (lobbying)

2. C.A.R. - $180.89 (lobbying)

3. Subscription to California

Real Estate Magazine - $6.00

-------------------------------------------------------------

2024 Estimated Portion of

Your Dues that are Non-Deductible

1. NAR - $55.00 (lobbying)

2. C.A.R. - $78.56 (lobbying)

3. Subscription to California

Real Estate Magazine - $6.00

-------------------------------------------------------------

2023 Estimated Portion of

Your Dues that are Non-Deductible

1. NAR - $51.00 (lobbying)

2. C.A.R. - $79.18 (lobbying)

3. Subscription to California

Real Estate Magazine - $6.00

-------------------------------------------------------------

2022 Estimated Portion of

Your Dues that are Non-Deductible

1. NAR - $57.00 (lobbying)

2. C.A.R. - $77.50 (lobbying)

3. Subscription to California

Real Estate Magazine - $6.00

-------------------------------------------------------------

2021 Estimated Portion of

Your Dues that are Non-Deductible

1. NAR - $57.00 (lobbying)

2. C.A.R. - $77.84 (lobbying)

3. Subscription to California

Real Estate Magazine - $6.00